The graph shows the current spot prices for Cobalt and Nickel. The vast majority of demand prior to 2019 originated from around 35 other industrial uses for cobalt, excluding EV’s. It is economically reasonable to suggest the demand curve for cobalt and nickel will continue to shift outwards as demand from the EV revolution continues to materialise.

Cobalt Demand

Many countries include cobalt on their list of critical minerals. Its unique combination of properties make it ideally suited to high temperature, high-wear application including superalloys for jet engines; magnets; carbides; and diamond tools. Most significantly, cobalt is also used in batteries, catalysts and pigments.

Physical Properties

Cobalt’s Critical Roles

The physical properties of cobalt, being thermal stability and energy density, are what make cobalt an essential ingredient in the cathode of lithium-ion batteries. The drive for improved battery performance has seen Nickel-Manganese-Cobalt cathode chemistry rise to be the dominant chemistry. NMC532 (5 parts nickel, 3 parts manganese, 2 parts cobalt) remains the dominant cathode chemistry with NMC 622 use expanding (both at 20% cobalt content). However, given the high value of cobalt, increasing demand and limited supply, there has been a push to develop NMC 811 technologies to move towards higher proportions of cheaper nickel and less expensive cobalt (10% cobalt content).

Recent incidents of battery combustion have highlighted the critical role cobalt plays in battery chemistry stability. A minimum amount is essential. Below that minimum, cobalt cannot be substituted, regardless of the cost.

Cobalt Mining

A Deeper Understanding

99% of all cobalt is mined as a by-product of nickel and copper mining. For new cobalt to enter the market, these mines require an increase in nickel and copper prices. In Australia, most nickel laterite projects require high pressure acid leaching (HPAL) to liberate the nickel and cobalt metals from the minerals. Typically, HPAL requires a capital investment of over AUD 1 billion.

Generally around 70% of global cobalt supply is mined as a byproduct from copper mines in the Democratic Republic of Congo (DRC) in central Africa. Of this about 20% is sourced from 110,000-150,000 artisanal miners often in unsafe conditions. Many fatalities occur in these mines and tens of thousands of children are often exploited in substandard working conditions. Ethically sensitive investors in major mining companies are becoming increasing strident in wanting their companies to seek cobalt supplies from sustainable sources but also adhering to minimum working standards and conditions. Mining countries such as Australia and Canada obviously meet these minimum standards and should receive more attention as future supply hubs.

Cobalt Output

Kalgoorlie-Norseman Cobalt Region

As well, a significant quantity of all the DRC cobalt output has already been pledged to China via various offtake agreements.

The Kalgoorlie-Norseman Cobalt Region offers a compelling alternative, being an advanced, low capital cost and high-quality cobalt project located in the stable mining jurisdiction of Western Australia.

Australian companies show respect for the law of contract and there are legislated requirements for the construction, operation and maintenance of mining sites which should appeal to those developers and investors uncomfortable with central Africa.

Kalgoorlie-Norseman Cobalt Region

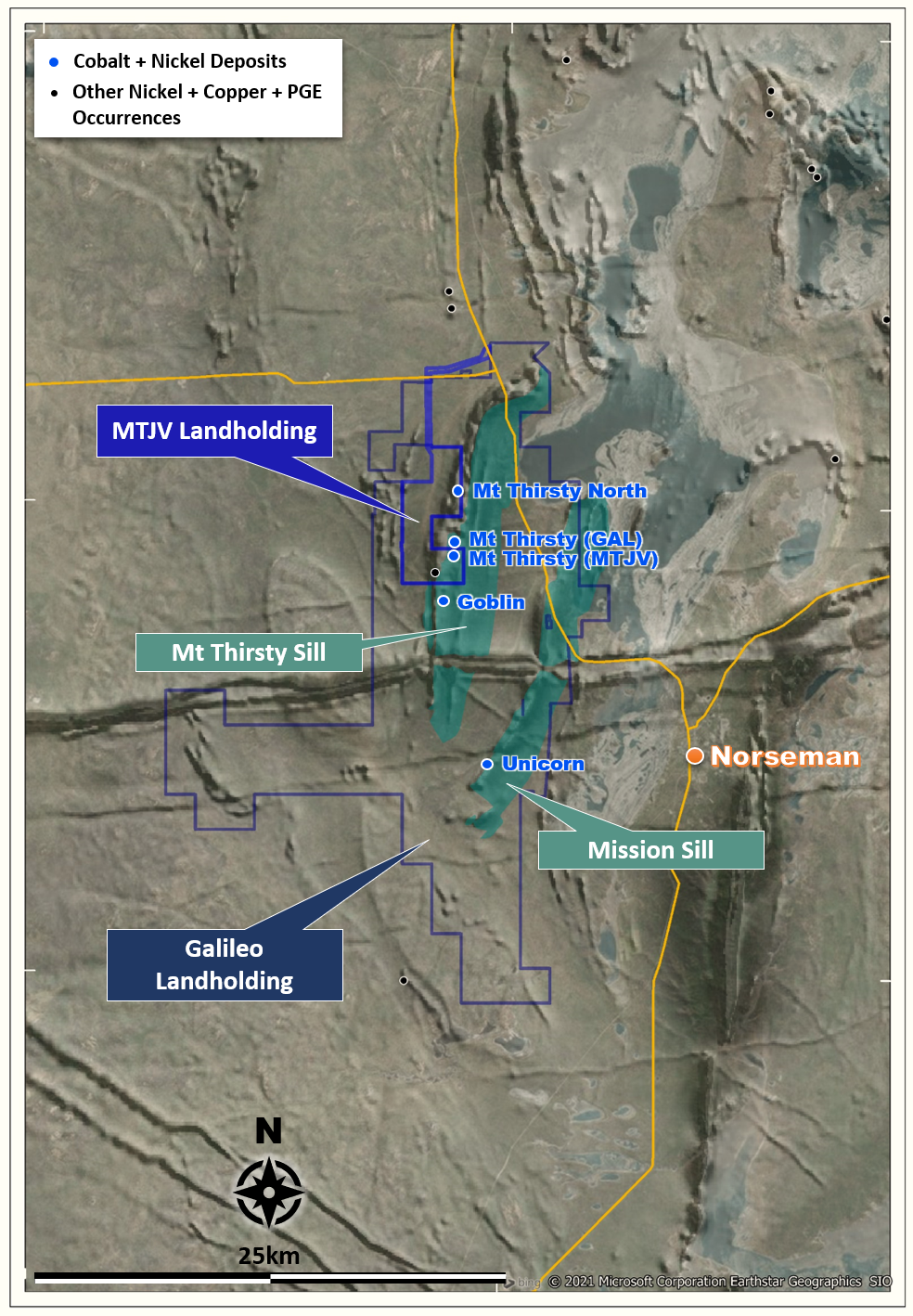

Located in the Eastern Goldfields region of Western Australia, approximately 16km north-west of Norseman. The area encompasses multiple adjacent mineral exploration tenements. The cobalt rich section of this area are currently owned by the Mt Thirsty Joint Venture (MTJV), a 50:50 joint venture between Greenstone Resources Ltd (ASX: GSR) and Conico Limited (ASX: CNJ) and across their tenement boundary an extension of the same resource owned by Galileo Mining Ltd (ASX: GAL). They hold an additional 12.5MT of indicated and inferred resource. As well, Galileo own a further 12.6 MT of inferred resources in adjacent tenements.

Geological indicators suggest that additional cobalt exists within this prolific mining region. Further exploration will be required to map out potential new supplies of cobalt to supplement the substantial resources currently owned by all three companies.

The Project is close to all necessary infrastructure (rail, road, power, gas, water, townsite, fibre optic, airport and seaport) and, being in a mining orientated state, has the potential to attract a variety of interested parties including end users of cobalt.

Want more information? Contact us today

Pre-Feasibility Study

A Pre-feasibility study (PFS) for the MTJV Mt Thirsty Cobalt-Nickel Project was completed in February 2020. The PFS returned a positive pre-tax Net Present Value with a low capital cost of $371 million (including direct costs, growth allowance, owner’s costs and 10% Contingency) (refer to BAR ASX announcement dated 20 February 2020).

This makes the region one of the most advanced cobalt projects in Australia and a high value development opportunity for a large global firm, eager to secure a guaranteed sustainable source of cobalt.

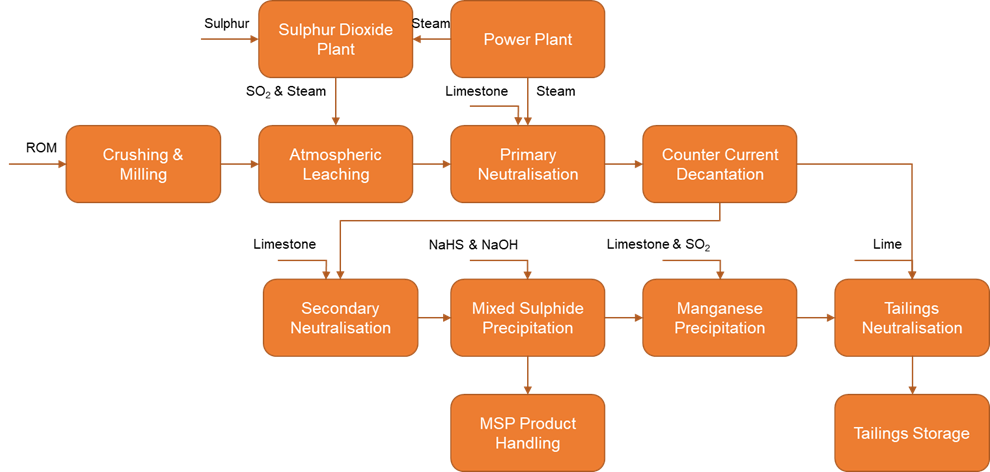

The MTJV opted to test atmospheric leaching as the preferred process in the 2020 PFS, principally based on reducing the capital outlay. However, the decision does not rule out other processing techniques, notably HPAL. The principal tenement owners in the region have decided to adopt a flexible attitude to any corporate development pathway that may interest a potential suitor. Simple arithmetic by aggregating the resource tonnages spread across the entire Mission Sill may open up potential for alternative flowsheet processing designs.

We encourage groups to make enquiries now. Click here to find out how you can access the 2020 PFS in full.

We invite you to get in touch to discuss any potential development opportunities

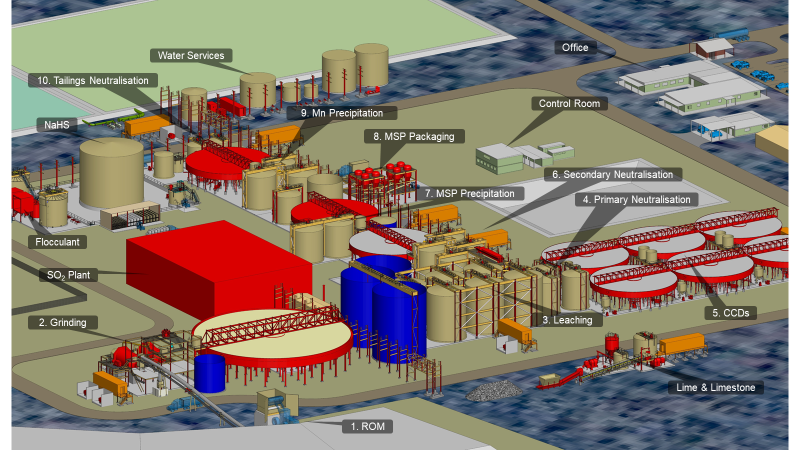

3D isometric of the Mt Thirsty processing plant showing generalised process flow (numbered labels)

Schematic Process Flowsheet for Mt Thirsty

MTJV Mineral Resource

|

Mineral Resource

|

Classification

|

Cut-off (Co%)

|

Tonnes (Mt)

|

Cobalt | Nickel | ||

| (%) | Tonnes | (%) | Tonnes | ||||

|

Mt Thirsty Main

|

Indicated | 0.06 | 22.6 | 0.12 | 26,200 | 0.53 | 119,800 |

| Inferred | 0.06 | 2.5 | 0.10 | 2,500 | 0.44 | 11,000 | |

| Sub-Total | 25.1 | 0.11 | 28,700 | 0.52 | 130,800 | ||

| Mt Thirsty North | Inferred | 0.06 | 1.5 | 0.09 | 1,400 | 0.55 | 8,200 |

|

TOTAL JORC (2012) Mineral Resource

|

26.6 | 0.11 | 30,100 | 0.52 | 139,000 | ||

Galileo Mineral Resource

|

Mineral Resource

|

Classification

|

Cut-off (Co%)

|

Tonnes (Mt)

|

Cobalt | Nickel | ||

| (%) | Tonnes | (%) | Tonnes | ||||

|

Mt Thirsty Sill

|

Indicated | 0.06 | 10.5 | 0.12 | 12,100 | 0.58 | 60,800 |

| Inferred | 0.06 | 2.0 | 0.11 | 2,200 | 0.51 | 10,200 | |

| Sub-Total | 12.5 | 0.11 | 14,300 | 0.57 | 71,100 | ||

| Mission Sill (Unicorn) | Inferred | 0.06 | 7.7 | 0.11 | 8,200 | 0.45 | 35,000 |

| Goblin | Inferred | 0.06 | 4.9 | 0.08 | 4,100 | 0.36 | 16,400 |

|

TOTAL JORC (2012) Mineral Resource

|

25.1 | 0.11 | 26,600 | 0.49 | 122,500 | ||

Contact a representative of the project to find out more

Have an enquiry?

Contact us.

For more information, don’t hesitate to contact us today.

Greenstone Resources

16 Ord Street, West Perth, WA 6005

Email: admin@greenstoneresources.com.au

Web: www.greenstoneresources.com.au

Tel: +61 8 9481 3911

Galileo Mining

13 Colin Street, West Perth, WA 6005

Email: info@galileomining.com.au

Web: www.galileomining.com.au

Tel: +61 8 9463 0063

Conico Ltd

Level 15, 197 St George’s Terrace, Perth, WA 6000

Email: mailroom@conico.com.au

Web: www.conico.com.au

Tel: +61 8 9282 5889